Elon Musk, the CEO of Tesla, SpaceX, and Twitter, issued a warning on Thursday over the negative effects of the Federal Reserve’s swift increase in interest rates.

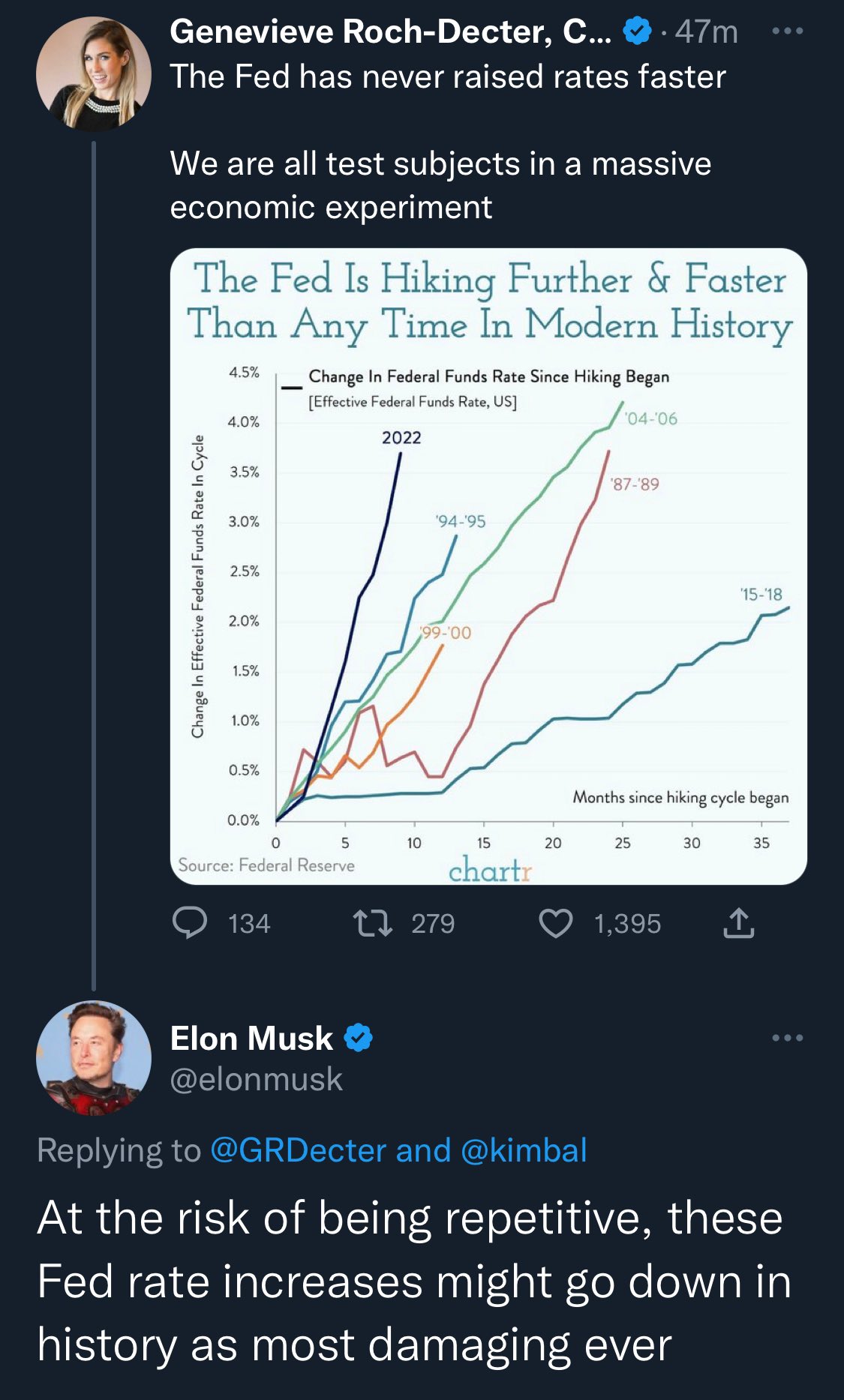

In response to Genevieve Roch-tweet Decter’s claiming “the Fed has never hiked rates quicker” than this year, he issued a caution.

Musk received a lot of support. “I concur, Elon. The mortgage sector is experiencing a bloodbath. Good workers like me, in marketing, were laid off. Applications are at all-time lows. This is a catastrophe,” a Twitter user said. Another person said: “This is what happens when the government injects $3.5 trillion artificially into the American economy. The Fed makes up for it with harmful interest rate increases. The situation will worsen.

Musk also attributed Tesla’s decline in market value to the Federal Reserve. “Elon has now wiped $600 billion of Tesla value and yet nothing from the Tesla BOD [board of directors],” investment advisor Ross Gerber tweeted last week. Absolutely unacceptable

The billionaire has issued numerous cautionary statements regarding the dangers of interest rate hikes by the Federal Reserve. He issued a warning earlier this month that if the Fed raises interest rates once more, the recession will be severely exacerbated. After four consecutive 75-basis-point rate increases, the central bank increased rates by 50 basis points.

Musk emphasized that the Fed “has to decrease interest rates immediately” last month, saying that the “trend is disturbing.” They are significantly increasing the likelihood of a severe recession, he continued. Additionally, according to the billionaire, the recession will continue until the spring of 2024.